about a month ago i wrote about dealing with money with faith instead of fear. this has been a journey the Lord has had me on for the past several years, and i am learning one baby step at a time how to really trust Him when it comes to money.

i promised an upcoming post about tips to save money on food while eating healthy and primarily organic. well… after two attempts to write it and it not saving, here it is! once i started working on this post i realized that there is so much that could be shared about this area of finances. each tip that i give could probably be a blog post in and of itself! i had to just pick a place to stop and realize that i am not giving you every tip i have learned, just the ones that come to mind right now. this means i need you to share things i haven’t mentioned in the comments below. also there may be a follow up post in the future on saving more money in your grocery budget.

before diving into my 12 tips on saving money of real healthy food, i wanted to share two amazing things i have found on this journey of living on a really tight finances as an intercessory missionary in the united states. the first one is, no matter how impossible it may look on paper, God always provides. there have been so many times that we just couldn’t explain it, but provision came at the 11th hour either in the form of money or food. second, having less money to spend on convenience teaches you how to be creative. (and really this applies to more than just food) i have learned how to do so many things i didn’t think i could do and have had fun doing it! our God is the Creator of the universe and He made each one of us creative. sometimes it takes uncomfortable circumstances in life for us to exercise that creative gift hiding inside.

1. budget. this seems like such a simple (or maybe not so simple) way to save money when it comes to food, but it has to be mentioned. i have found in my personal experience i always spend less money on food when i plan what we can and will spend. for quite a few years my husband and i have been fans of dave ramsey’s cash envelop system for groceries. it actually is a proven fact that people spend more using their debit card than they do when they have hard cold cash in their hand… why is this true? do we not really believe it is money we are using when we swipe the card? i know that it hurts more for me to spend cash, especially when i know that i have a limited amount in that envelop that isn’t going to be replenished until the next month. now, with being pregnant, i do try to budget what we will spend but i have slipped back into using our debit card for many of our grocery purchases. i know my own tendency to justify extra purchases i may not “need” when i am using a debit card, so i try to exercise extra self control and plan on going back to the cash envelop very soon because it just works. i strongly discourage buying groceries on a credit card. i could write a lot about this, but let’s just say it isn’t a wise way to save money even if they offer you cash back bonuses.

*note: my advice on budgeting to anyone who asks is make sure you and your spouse are on the same page. in most families, including ours, one spouse does more of the money stuff for the house. both, however, need to take the time to talk about where money is going, make a plan, and have an honest conversation about problem areas in personal finances. money can be a very sensitive issue in marriage and is definitely not the place to manipulate and control. if you have different views on what you should be spending on food than your spouse, talk about it and show some real numbers of where your money is going so that it isn’t just an abstract number. if you still can’t agree, chose humility and make the necessary sacrifices to serve your family. then pray that that Lord would change either your heart or your spouse’s heart so that you can work together on this vital family issue.

2. meal plan – i have found meal planning to be the best way to stick to my #1 suggestion of working with a food budget. when you plan what you are going to eat during the week, you are going to have direction when shopping, and will naturally buy less unnecessary items and waste less food. if you are tight one month on money to spend on food, plan most your meals around ingredients you already have on hand (maybe frozen chicken, or pantry items, or dried goods). i have found taking the time to meal plan has got me out of my food ruts and forces me to be creative with what i have, only buying the items i need to complete a meal.

now, i know that meal planning can seem intimidating if you have never done it before… at least it was for me! i have friends like katie who have amazing detailed meal plans every week that are extremely organized. personally, i mostly just take the time to plan out dinners and then make notes about breakfast, lunch, snack, and dessert ideas. i am not super strict about sticking to the plan either. for example, if one night i have more time for prep than another, i may switch which dinner i was planning on making. also, if i find a great sale on something at the store i wasn’t expecting, i will sometimes make a last minute revision to take advantage of the great deal. i often leave at least one dinner of the week blank, planning to have leftovers from another meal i made. i encourage you to try meal planning for a month before you decide if it is for you. i can almost guarantee that you will save money at your shopping trips and feel like a faster, more efficient shopper.

3. join a food co-op. i have bought from azure standard for almost 2 years now and it has been one of the biggest money savers for our family. they are a christian owned company based out of oregon with excellent customer service. check on their site to see if they deliver near you, and if there isn’t a drop point yet then you can organize one!

the types of items i order are things i can buy in bulk and store as pantry or freezer items. we order so many different things from azure including flour for both bread making and baking, rice, beans, lentils, coconut oil, unrefined sugar, coconut milk, seasonal produce, teas, herbs, oats (both rolled and steel cut), meats, and so much more. i have a good idea of the best prices in town for the items i order and i know that i am getting the best deal possible. if it is more expensive with azure, i simply buy it at the best priced place in town.

one example would be that the past couple months they have had “in season” juice grade organic apples for only $10 for 20 lbs. these are apples that are “imperfect” with little visual flaws or not perfectly round, but so sweet and lovely for so many uses. over the past 3 months we have ordered 100 lbs of these apples! where else can you get organic apples for 50 cents a pound?

4. invest in food grade 5 gallon or 2 gallon buckets and gamma lids to store your great bulk purchases. these are available at azure as well, and protect food from both the elements and pests, making it possible to enjoy the deeper discounts for larger bulk purchases. we have recently bought 33 lbs of rapadura, 25 lbs of steel cut oat, 25 lbs of red lentils, 25 lbs of pinto beans, among other large bulk items and store them in these handy buckets in our garage.

5. join a csa. now i know this one may not be applicable to everyone. we personally eat a lot of produce and don’t have picky eaters. if you are someone who values organic local produce, this may be the very thing for you to save money and get great quality produce.

we have been members of abundant harvest for 3 months now, and it has been more of a blessing than i even expected it to be. we are a family of 6, soon to be 7, who eat a considerable amount of produce (i used to be a vegetarian back in the day and so i still enjoy incorporating veggies into everything we eat). we get the “small” box of produce every week for $21.80 and it is jammed packed with so much produce i am constantly searching online for new recipe ideas to use up our veggies. i have been able to try new things that i may not have bought in the store, and a couple are now new family favorites such as saute bok choy and sweet potato bisquits. we also have the opportunity to chose add ons to our order, such as in season organic oranges for just $5 per 10 lbs bag. our deliveries are on tuesdays and the items in the delivery are posted on their website the thursday before, making it possible to meal plan off of what we will be getting. one great thing about getting produce from a csa besides saving money is that you are supporting your local farmers and getting incredibly fresh produce (ours is picked within 24 hours of receiving it!).

again, it may not be the right fit for your family, but it has saved us money and expanded my creativity in cooking and baking.

*tip: don’t wash your produce right when you get it, but instead right before you use it. this should extend the life of any produce you buy.

6. grow a garden. we have been growing in this area over the past 5-6 years. we started with a herb garden on our porch in little pots. i figured the most expensive purchase at the grocery store are those little bundles of fresh herbs and i wanted to enjoy them in our food without breaking the bank. basil, thyme, and mint are incredibly easy to grow in pots, as are many types of veggies like peppers and tomatoes.

this year we made 2 raised beds in our backyard for veggies and had moderate success with minimal sunlight. we only get maybe 3 hours total, not consecutive, of direct sunlight in any area of our backyard, but we were still able to grow tomatoes, peppers, cucumbers, basil, potatoes, carrots, and squash. i have yet to master growing carrots as mine look pathetic every year, but i keep trying. it is both fun and money saving to grow your own veggies and herbs, so give something a try. a year and a half ago i had so many zucchini (my favorite) and ate them for lunch every day for weeks in the summer. as i said, it doesn’t matter if you have land or not (pots) or if you have sunlight or not (our backyard)… something will grow if you at least give it a try!

7. consider raising chickens. now i have wanted to own chickens for a while, but my husband was the one who pulled the trigger on this one this past spring. i wasn’t thrilled about getting them right now because we have no pets and didn’t want the commitment of raising animals. let me tell you how incredibly easy they have been! our 3 hens are laying an average of 1 egg a day each, and my sweet boy david gets to go on an egg hunt every day because our hens are free range (in the truest sense of the word, refusing to even sleep in their hen house but roosting on a rose bush at night) and lay all over the yard in little hiding spots. what other pet rewards you for feeding it with food to feed you? it is awesome and they are so much tastier than store bought eggs.

two other benefits for us to having hens is i feed them the leftover bits and pieces of our produce and they act as the compost pile for me and in return they give me great fertilizer for the garden. warning on the chicken waste: you need to wait a month before putting it in your garden or it can burn your plants. people pay money for this stuff – you may consider selling it even to your gardening friends! we rarely buy chicken feed and our chickens know whenever we open the kitchen door that they probably have food coming. some of their favorite treats: apple rinds and peels, watermelon rinds, pumpkin rinds, pomegranate rinds, and cilantro… oh yeah, and the lettuce i was trying to grow in my garden… they sure enjoyed that…

8. find the stores that are the best prices for what you buy and plan your shopping trips accordingly. to also save in gas, i plan out my grocery store runs based on where i am already going during the week – if i am picking up a child from school i may run by costco afterward to stay on the same side of town or go to a local market for a couple specific items when i am already out at the starbucks next to it. i love a good deal, so i do not shop at one place for everything. it may help to keep either a little notebook in your purse or use the notes app on your smart phone to keep track of average prices of items you buy often so you can spot a good deal and stock up! i love sales and coupons, but i only use them on items we already use. i cannot stress that enough – no one store is the best price for everything and coupons and sales do not save you money if you weren’t already planning on spending it! be a smart shopper and not an emotional shopper – i have been both and i know emotional shopping does not save money, it just fills our kitchen with random food we may or may not even like and makes meal planning harder not easier.

an example of saving money at the right stores is we found 2 lb bags of kirkland brand espresso roast at costco is actually roasted by starbucks for half the price of buying the beans straight from starbucks! when i have a husband who worked at starbucks for 7 years and is a devoted coffee drinker, it helps to find good beans for a good price!

9. invest in a freezer. we just recently did this very thing and i am so excited to be able to batch cook and really take advantage of great bulk prices on things i can freeze. i have used the little freezer on our fridge to the max and there are many ways you can use even that little one to save money. we recently went in on a local cow with several friends of ours, getting a great price for good meat. i look forward to buying a bigger percentage of a cow next time we order, as well as sending that husband of mine hunting with his bow. i haven’t done much batch cooking, as my kids eat huge quantities already and i didn’t have a big place to store it, but i sure plan to now!

10. learn to love ethnic food. i know that everyone has different food preferences, but i can tell you that ethnic food is cheap for a reason! think of the income levels of most people in mexico, or india, or thailand. their food may have some pricey spices (which you can find good deals on if you look around), but the staple ingredients are often dirt cheap rice and beans or lentils. you can get tons of flavor and variety and yet not spend a ton if you learn to both like ethnic food and then how to make it yourself. i love the fact that i can make a mean thai curry that feeds my whole family for the price of a single serving take out at the local thai restaurant. also rice, beans, and homemade tortillas has got us through many a seemingly impossible financial month and my kids think it is a special treat.

11. avoid anything pre-packaged and instead make it yourself. we rarely buy anything that comes in a package for both health and financial reasons. however, i stopped buying boxed food such as cereals (except occasionally now) and crackers because of how expensive they were, not because of if they were good for us or not. i know the convenience of pre-packaged snack foods can be very hard to break, but it will save you so much money when the boxes are usually about $5 a piece and if you are like us you can fly through them without even realizing it.

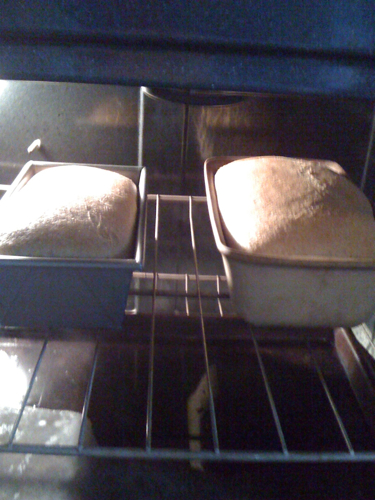

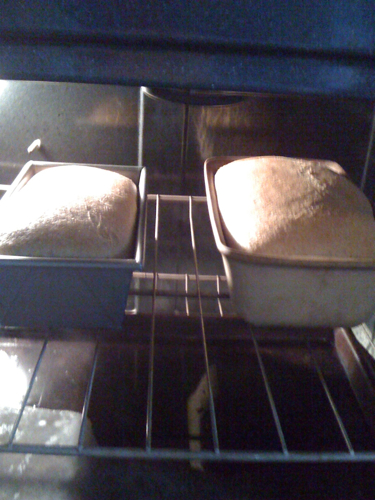

a couple years ago we started a quest to make homemade bread. we have definitely refined our methods and can make great wheat oven bread most of the time (we do have our occasional flops!), but since i have been pregnant we got a bread machine because my energy was just not there to do the oven method. bread makers can be found used on craig’s list for super cheap and pay themselves off very quickly if you have kids who eat sandwiches for lunch most days. making our own bread has definitely saved us money and we get to control what ingredients are in there!

i have slowly learned how to make pretty much all the food we eat myself. it is always cheaper and usually tastier, plus i know exactly what is in it (no weird list of ingredients i can’t pronounce)! with the internet age we are in, recipes to make stuff yourself are so readily available there is no reason why anyone can’t experiment and try something new. my sister makes great homemade wheat thin crackers which we have made a handful of times. you really can save tons of money making stuff yourself. it doesn’t have to consume your time either – this is where a plan is invaluable! don’t try to do too much at once, but plan what you will try and when you will do it so it fits into your life.

*money saving tip: an easy thing to make that saves money is homemade chicken stock (or bone broth). after eating a chicken, cook the bones on low in your oven with apple cider vinegar or lemon juice for another hour or so, then put carcass in cold water in a big pot with a little bit of apple cider vinegar (the acid in the vinegar actually leaches the good stuff from the bones, making your stock very nurishing). i add in the ends of onions and the leaves of celery that i have saved and frozen (even a bigger money saver using scrapes!). i usually also throw in a bay leaf or two. i bring it to a boil, skim off any scum off the top, and then turn to low where it is just barely making a boil bubble and cook it 12-24 hours. i strain it into jars and put in the refrigerator and freezer to use all sorts of recipes. good broth at the store is pricey – a pint of organic chicken stock ranging from $2-4! you can make a whole pot with what you would have thrown away.

12. just say no to fast food. this should be an obvious one for those living on tight finances, but i am surprised all the time how many people spend money on fast food, even on things that would take the same amount of time to make themselves. just like many of the above ideas, this is where a plan is so so needed. if you already have planned what you are going to eat, the drive thru will not be as tempting. i know there have been times while pregnant that i just have to get a burger at in-n-out because i hadn’t planned what i was going to eat. it happens to everyone, but you will save money eating at home or packing something to take with you. for sure.

i know this isn’t a catch all list, so i would love your ideas of how you save money, and even links to recipes or blog posts you have used, in the comments below. this is a journey, so do not beat yourself up if you feel like you have a ways to go on making choices to save money with food. remember that every choice you make gets you one step closer to or one step further from saving money, so just take one step that you feel like you are able to do. i do not do all of these all the time – that would make me a super human that i am not! different seasons in life are easier or harder to do different things, but we all can do something new in making our dollars stretch for food for our family.

what is one step you are going to take to save money with food?

what is one suggestion you would give other readers that i may have not mentioned here?

thank you for joining me in this journey! God has always given us more than enough, sometimes we just have to have creative eyes to see it!

charis